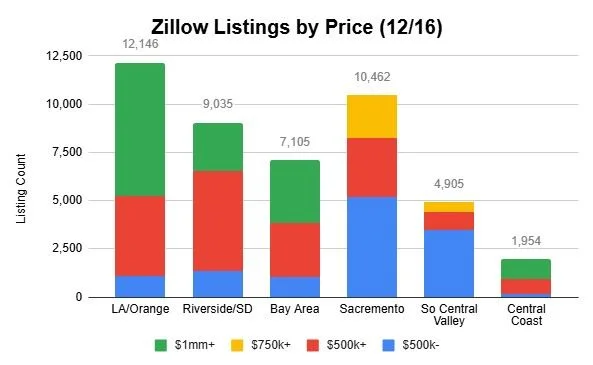

Inflation has bumped up and it's keeping rates high. However, the supply of homes priced under $500k has grown and is a great signal for 2025.

Published on 12/16/2024

Unsure how to close the financial gap to your dream home? Our expert advice will light the way to your home buying success.

Published on 12/13/2024

Learn how to buy a home with low income using practical tips, loan programs, and expert advice. Discover affordable options and assistance programs to make homeownership possible!

Published on 12/11/2024

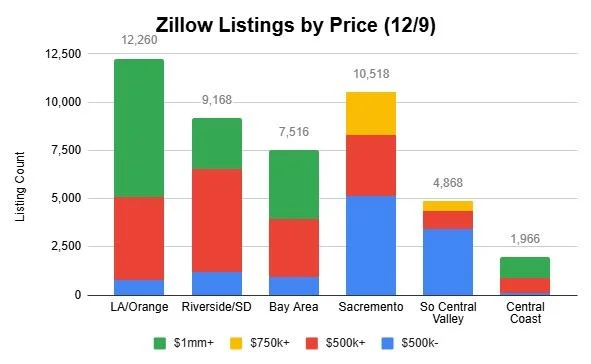

With moderate economic signals and improving mortgage applications, the housing market is setting up for big improvements in 2025.

Published on 12/09/2024

Affording a home in today’s market can feel overwhelming, but there are actionable steps you can take to make it easier.

Published on 12/04/2024

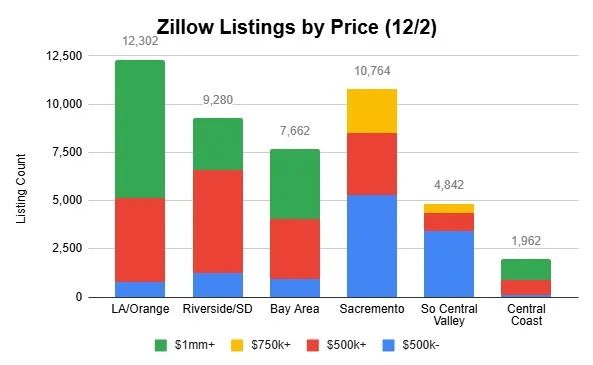

With Mortgage applications up and inventory falling, we are ahead of seasonal trends by about 6 weeks. If economic data shows a weaker economy, we should see mortgage rate spreads contract and give buyers better opportunities.

Published on 12/02/2024

While spring and summer are traditionally popular for real estate transactions, the fall and holiday months offer unique advantages that can make buying a home during this period particularly beneficial.

Published on 11/27/2024

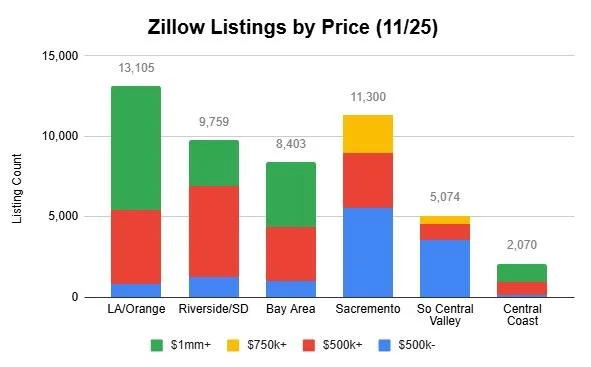

Purchase activity had slowed through November, but there are opportunities starting to show. As long as inflation fears continue to wane and December reports maintain that sentiment, Mortgage News Daily's 30 Y Fixed estimate should get to 6.5% by the end of the year.

Published on 11/25/2024

While living with parents can be a practical solution in certain circumstances, exploring homeownership can offer long-term financial benefits and personal growth.

Published on 11/20/2024

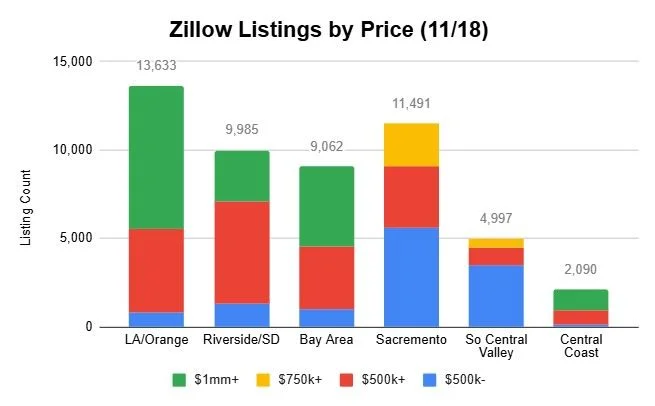

Supply is falling as demand is near recent lows. The only hope is that Mortgage rates begin to fall. Unfortunately, recent economic data and Jerome Powell speeches are bringing back inflation fears.

Published on 11/18/2024

While economic indicators like inflation and Federal Reserve policies are important, the current increase in housing inventory and slower price growth present a promising opportunity for homebuyers.

Published on 11/13/2024

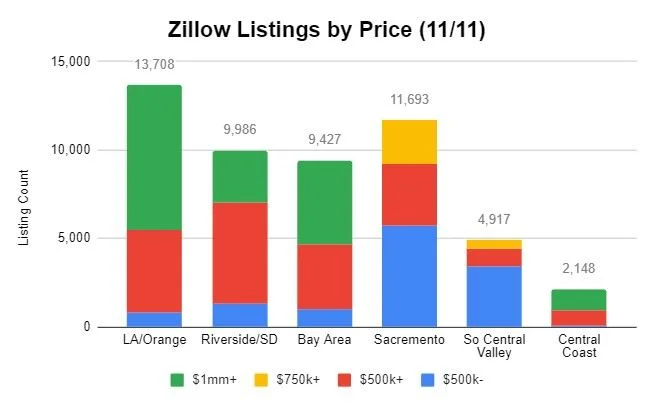

Weekly listings are flat while October Active Listings are pushing into 2022 highs. Demand is steady for homes priced over $1mm. Rates have stopped the upward trend and could fall if inflation fears subside and the Fed maintains an easing strategy.

Published on 11/11/2024

Explore how the Fed’s expected rate cut and recent election outcomes could impact economic policy, inflation, and job growth—what this means for borrowers and the broader economy.

Published on 11/06/2024

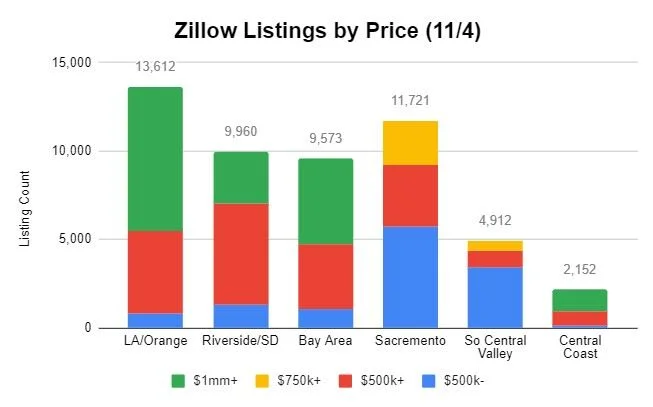

Supply of affordably priced homes improved slightly, while demand has begun to improve.

Published on 11/04/2024

Buying a home is one of the biggest financial decisions you’ll make, but it doesn’t need to be scary.

Published on 10/30/2024

Supply is increase for higher end homes, while demand is limited due to stubbornly high Mortgage Interest Rates.

Published on 10/28/2024

Learn how Non-QM loans provide flexible home financing options for self-employed individuals, freelancers, and those with non-traditional income. Discover if this alternative mortgage is right for you.

Published on 10/23/2024

Considering refinancing your mortgage? Learn how refinancing can improve your financial situation, when it makes sense to act, and what factors to consider. Contact us today for personalized refinancing options!

Published on 10/16/2024

Discover the top factors that can increase your home's value, from location and upgrades to market trends. Learn how you can boost your property's worth and when refinancing might make sense!

Published on 10/09/2024

Is buying a home during inflation a bad idea? Is it possible? Here are 6 tips for making the right move.

Published on 10/02/2024