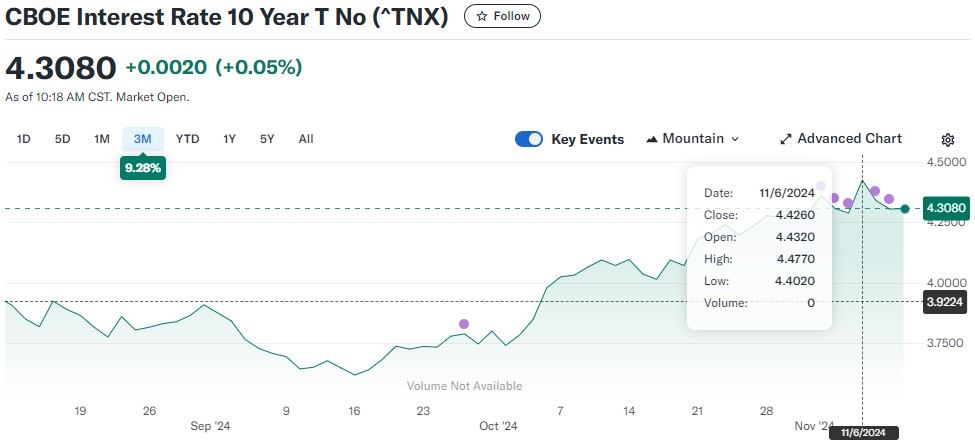

Rates have broken trend and are expected to continue to fall. At this point, I expect the 30 Year Conventional Fixed rate to bottom at 6.5% by the end of the year. This could push lower if economic data worsens and Trump doesn't lean into inflationary economic goals.

Supply

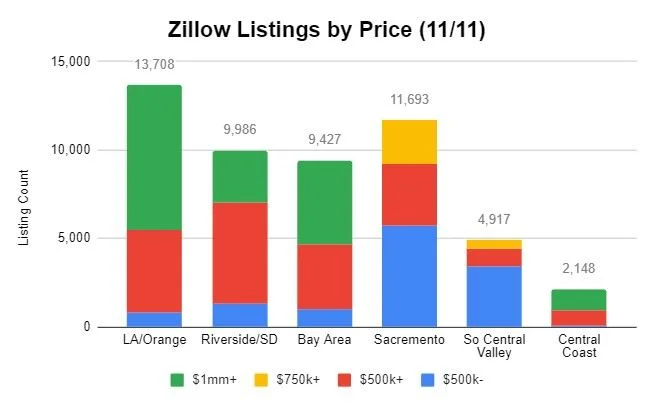

The official October sales/listing data came out last week and all markets had an increase in active listings. While this is seasonal and should be expected, all regions are showing highs not seen since August of 2022. On a weekly basis LA/OC increased Zillow listings by 2% and Riverside/SD increased by nearly 1%; all other regions had flat or declining listings.

Demand

In 2022, interest rates were rising allowing investors to justify buying and raising rents. In a declining rate cycle, investors will be less inclined to buy new properties. Homes are still selling at the higher price end, while homes priced less than $500k are increasing in supply (.08% from prior Week). I don't believe in a significant price correction, but there are signs of softening demand.

Developing Issues

While rates pushed higher after the election, Friday's close showed a break in the upward trend of mortgage rates. This week will confirm a downward trend or stagnant rates going forward. It is all dependent on expectations for employment and inflation for the rest of the year.

Daevin Thomas

424-222-0000