Supply

Across California, inventory has risen roughly 40% above last year's levels and slightly higher than the same time in 2022. Seasonally, inventory should stay high through November and begin to fall in December. Days on Market reflects a similar pattern across the state. We should expect homes to take longer to sell rising to 65-70 days by early January.

Demand

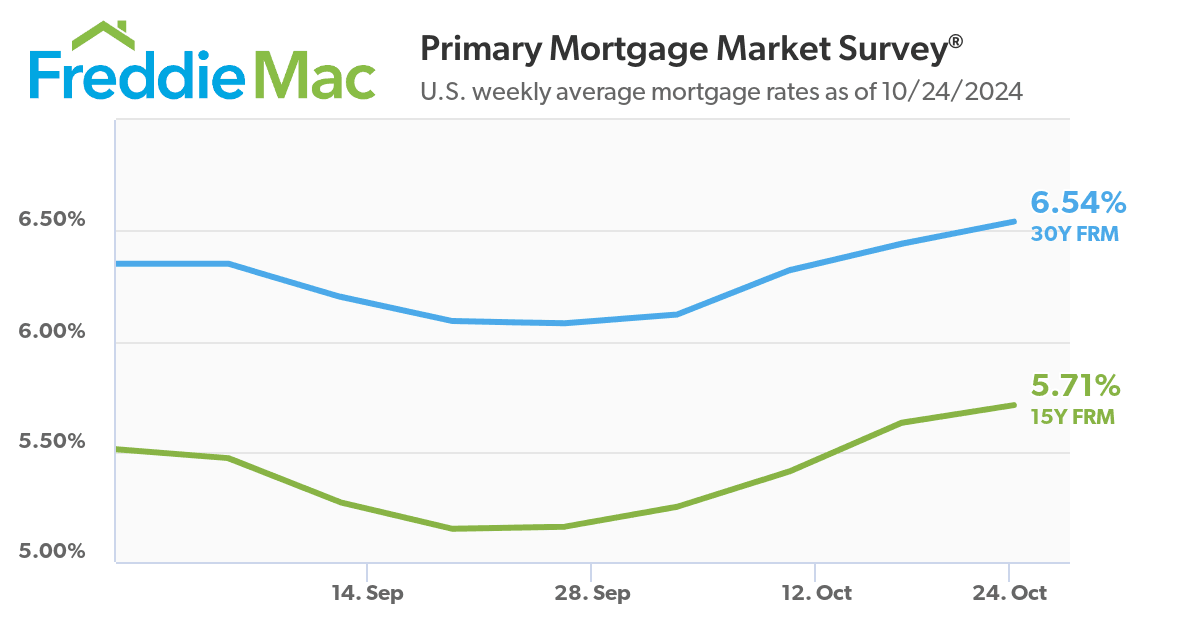

Prices continue to rise across the state while Mortgage Interest Rates have been increasing since mid-September. At a regional level, the Sacramento to Stockton area and Bay Area have seen flat or declining prices allowing for better sales activity.

Across the US, Mortgage Applications have cratered over the past 4 weeks. While this is a seasonal trend, we haven't seen such a strong decline since March 2020. Based on trends, we should expect some increases in applications in November and December with the peak increases coming in January and February.

Developing Issues

A common narrative is that home buyers are waiting till after the election. There isn't any data to support this claim, rather we can expect to see improvements based on normal seasonality. However, all economic data is confirming the soft landing and a stable economy. This week we expect the Case-Shiller Price Index to show a 5.1% price improvement on Tuesday; a .1% improvement for September Pending Home Sales on Wednesday; Friday we expect a flat Unemployment Rate and Construction Spending.

These flat to positive results will strengthen the case for the Fed to keep the Federal Funds Rate stable and maintain the elevated Mortgage Interest Rates.

While conditions are difficult for buyers, they should be aware of the greater opportunity for down payment and buydown incentives. Let's work together to help the American dream happen.

Daevin Thomas

424-222-0000