Developing Issues

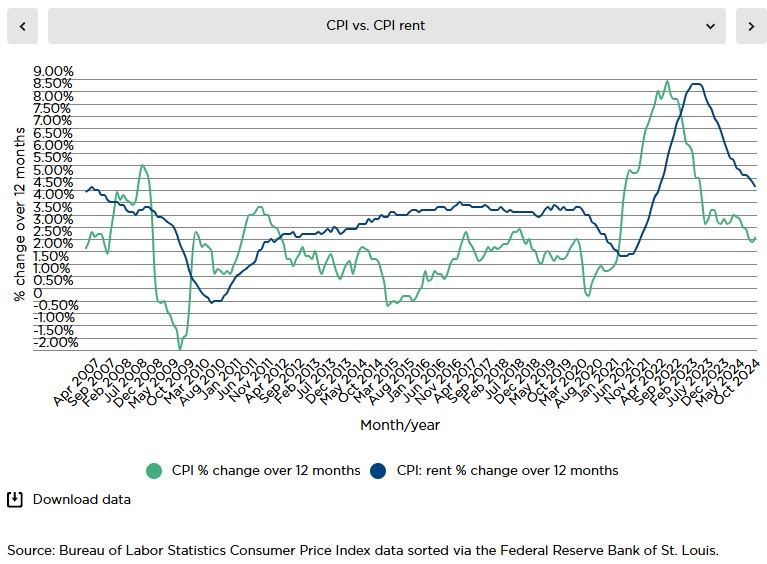

CPI and PPI have shown signs of increasing inflation. The Fed has hinted at slower rate declines, but is staying committed to rate cuts. The biggest reason to believe inflation will continue to fall is because the CPI-Rent category is still falling. While the 2% target has been stubborn, the following chart and seasonal expectations will keep the Fed in rate cutting mode. December economic data will set the tone for 2025.

Demand

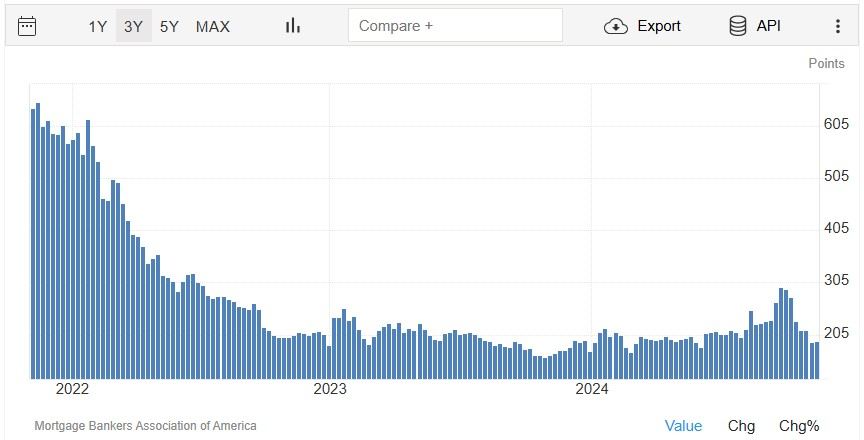

The current Mortgage Index is roughly at the same level as this time in 2023. I don't expect demand to improve until January/February. How strong of an improvement will be based on Mortgage rates at that time. If the 30 Year Conventional fixed rate gets close to 6.25% by May, sales could potentially double. If rates stay near 7% sales will rise slightly over last year.

Supply

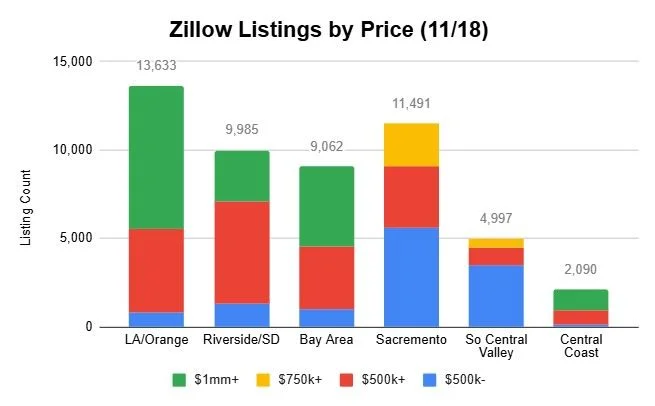

Across the CA markets I track, Zillow listings declined by 1.2%. The decline was led by the higher priced homes, while supply of homes priced $500k and lower increased in all regions excluding the Bay Area and Sacramento. Based on what I'm hearing, supply is lower mostly due to listings being pulled until the new year.

Daevin Thomas

424-222-0000