Developing Issues

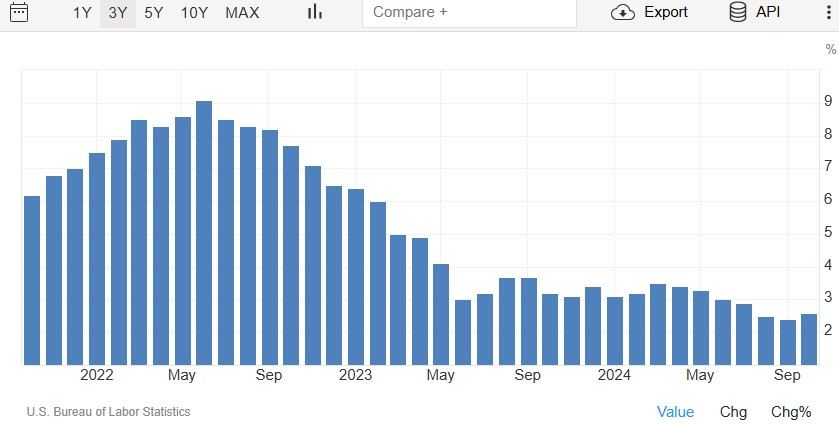

The CPI (Inflation) reports are the key economic indicators to watch. It is expected to increase to 2.7% from 2.6% last week; if the report posts a rate higher than 2.7% there will be concern the following week's rate cut won't happen and mortgage rates will push higher. I am looking more towards Q1 2025. Inflation has been ticking up slowly with stable employment; I expect the rate cut to happen next week, with signals that the Fed will pause further cuts unless the economy worsens.

CPI Rate

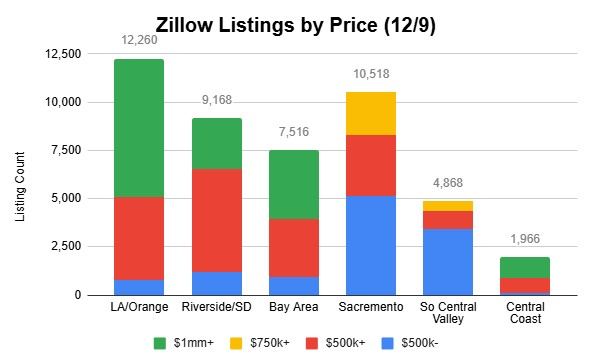

Supply

Across these regions, listings fell by 1.1% since last week with the Bay Area and Sacramento declining by 2.0% roughly with a few new listings under $750k in the Fresno to Bakersfield region and the Central Coast. When listings grow, we can focus on these price ranges. If new listings are focused at $1mm+ we can expect higher prices with low volume; if listings grow under $1mm, we can plan for higher volume with stable prices.

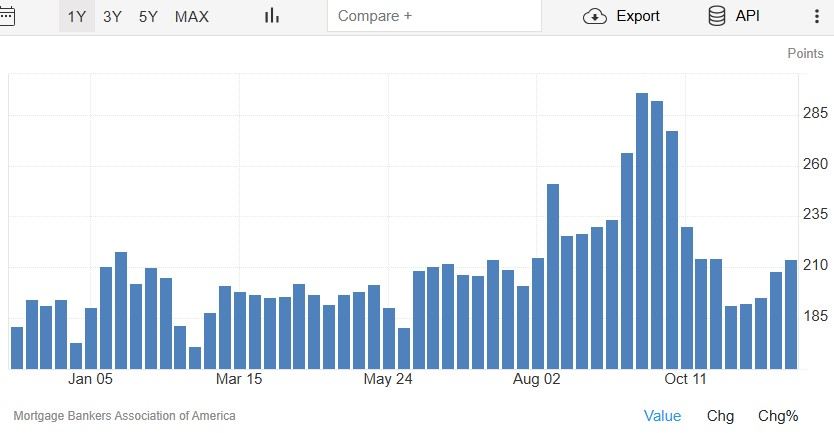

Demand

Demand continues to grow across the country with the applications index stronger than most of the past year (excluding September's rate declines). Demand is near certain to boom if mortgage rates push into the low 6% range.

Mortgage Application Index