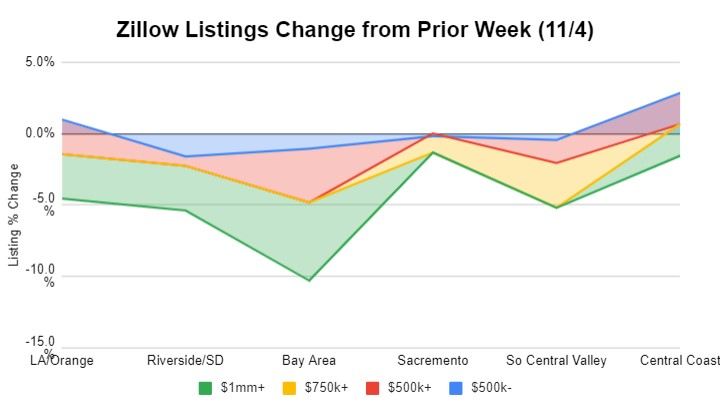

The Zillow listings of the regions I service has declined by 1,086 or 2.05% with Bay area homes over $1mm having the greatest loss of listings at 5.5%. This matches the national trend of an improvement in mortgage applications.

Developing Issues

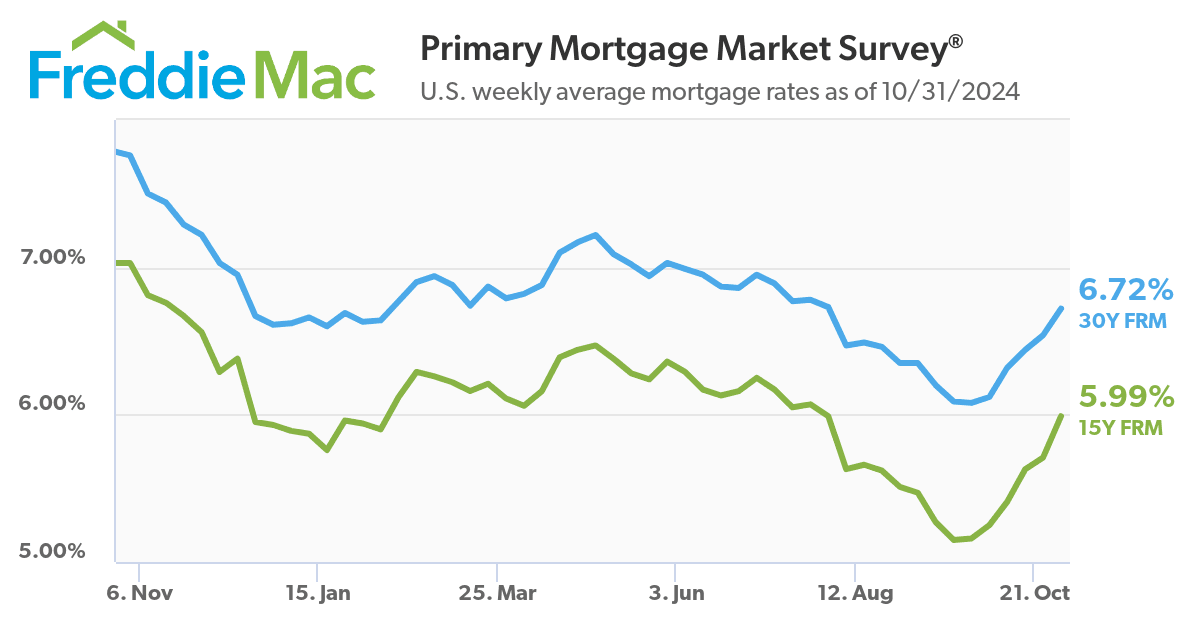

While Fixed Rate Mortgages rates continued to increase last week, there were better indications of what is driving it: Federal Debt. The treasury finished their Aug.-Oct. auctions while indicating increased auctions needed going forward to fund the government. The auctions are expected to increase by roughly 23%. Overall, it seems bond traders have bid up the 10Y yields due to the increased supply of bonds thus causing increased mortgage rates.

On the positive side, the market expects the Fed's statement on Thursday to confirm a .25% reduction of the Federal Funds rate. This should break the upward momentum of mortgage rates. If the fed indicates continued easing, we could see the trend fully reverse and see lower rates. If there is uncertainty of easing, rates might be stuck in the 6.25 - 6.75% range until there is more confidence of lower rates.

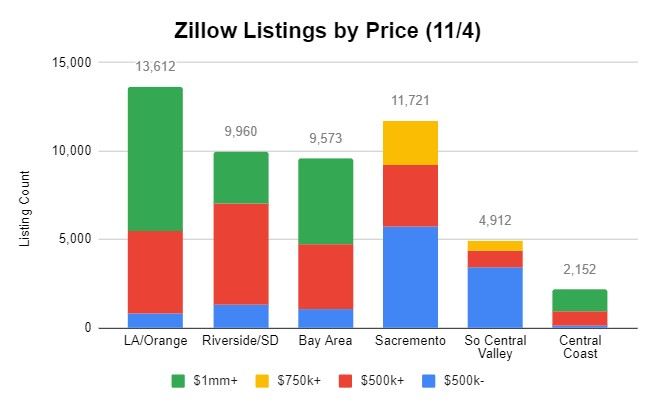

Supply

Across California, inventory has risen roughly 40% above last year's levels and slightly higher than the same time in 2022. As expected, the supply has declined by 1,086 listings on Zillow since last week. The Bay Area had the largest decline of 4.4%. Across regions, the homes priced over $1mm declined by 3.7%.

Homes for $500k and less declined by .4% across regions and increased by +1% for the L.A./Orange County region and +2.9% for the Central Coast. This segment is a leading indicator for the market returning to normal business activity. If lower priced inventory increases, there will be more demand for the $500k - $1mm segment and continue up the chain. Keeping stable levels of the low end inventory is better than seeing that supply decline at this point of the season.

Demand

The Mortgage Application Index has been trending in the right direction and is expected to currently be rising compared to the last several weeks. At a regional level, the Valley regions continue to have plenty of affordable homes available with limited demand. The data is showing continued strength (comparatively) in the L.A./Orange County and Bay Area regions for homes priced $1mm+.

If last year's pattern continues, we can expect to see increased activity until a drop off in Thanksgiving week. December should see continued improvements into the new year.

Conditions continue to be difficult for buyers, but I am always looking for new incentives. I am seeing a lot of opportunities for 3-5% incentives with lower requirements for every type of buyer.

Daevin Thomas

424-222-0000