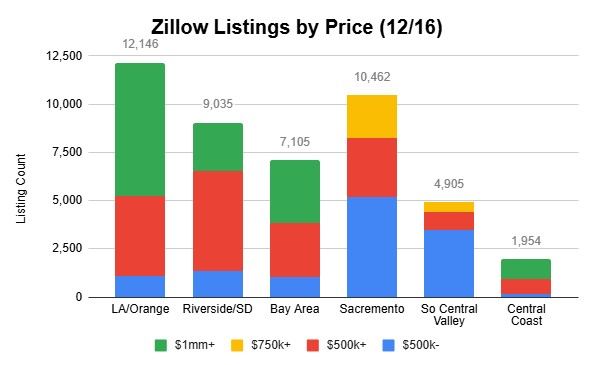

Supply

Compared to last week, there are 1.5% (690) fewer homes available for sale. That decline is mostly in homes priced $500k and higher. Supply has improved for homes under that amount by 5.7% across all regions. It's implied that those sellers will now be looking for homes in the higher price ranges. If growth in the affordable range continues to grow, California could get back on track for normal sales volume in 2025.

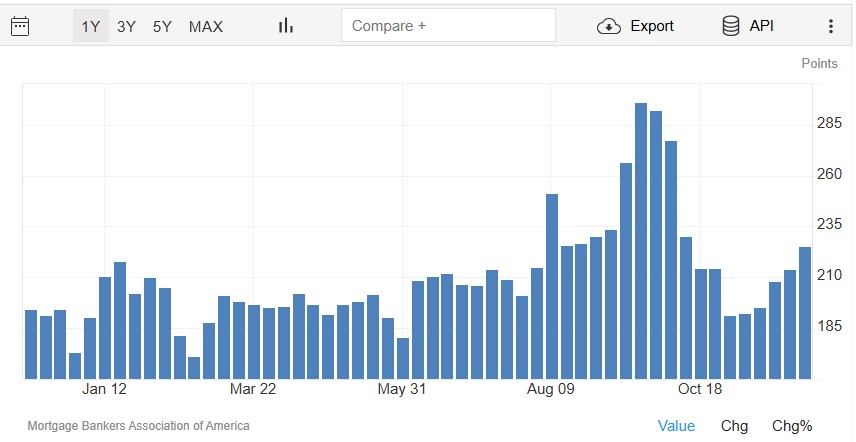

Demand

The Mortgage application index is also rising nationally to levels only seen during the interest rate declines in the fall. There will likely be a drop over the holidays, but continued strength in January.

Developing Issues

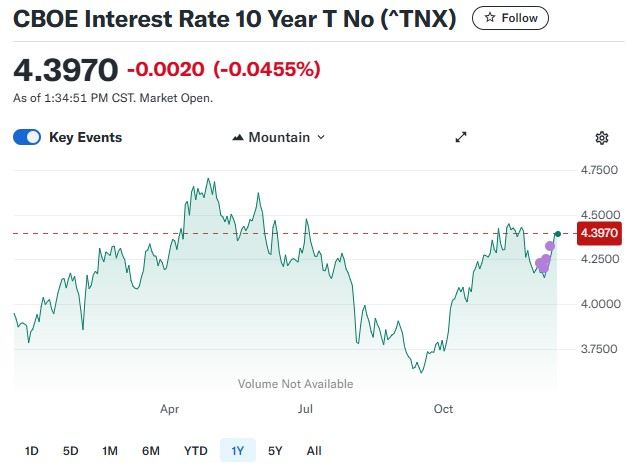

The 30 year Conventional Mortgage seems stuck in the 6.75-7.0% range until inflation is under control. The primary concern of Bond traders is that the rate declines were too soon and will need to be clawed back till inflation is below 2%. That will keep the US debt unsustainable as the new administration enacts policies that are mostly inflationary, adding to the problems. If the inflationary cycle calms, I don't expect to see improvement until March at the earliest.